The global landscape of medical equipment procurement is quietly undergoing a transformation. The traditional supply chain, centered around European and American brands, is now facing dual challenges of budget tightening and efficiency optimization. As a result, Asian equipment—offering high cost-performance and system integration capabilities—is becoming a top priority in the new generation of procurement lists. For Central American countries long plagued by medical resource shortages and outdated equipment, solutions from Asian manufacturers—renowned for their technological maturity, modular flexibility, and pricing advantages—are now seen as practical alternatives by healthcare institutions.

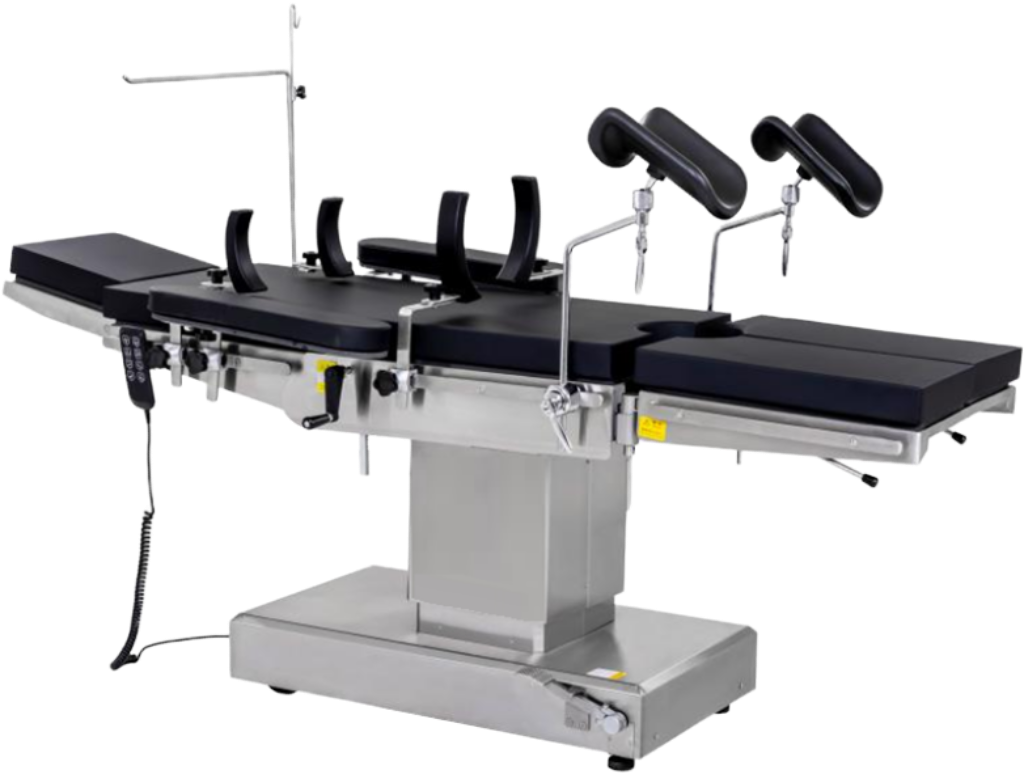

Costa Rica is leading this trend. In May this year, the country completed its first import and deployment of “One-Stop Integrated Operating Room” equipment, which includes surgical shadowless lights, electrosurgical units, medical gas systems, modular wall structures, central control consoles, and high-definition imaging transmission systems. To fully support the implementation of this integrated solution, MGCREA’s surgical lights were configured and functionally interfaced based on MGS’s system architecture, ensuring overall solution synergy. The equipment has now been installed and tested and is ready for clinical use.

This project was entirely designed and manufactured by Asian companies, while global medical integration service provider M&Y Global Solution (MGS) was responsible for the entire process from technical onboarding to on-site installation and staff training—demonstrating its full-chain integration and cross-continental delivery capabilities.

One Year of Detailed Preparation: MGS’s Full-Chain Execution Earns Trust

“From initial needs assessment to final equipment deployment, this project took exactly one year,” said Yogi Lü, Procurement Director of MGS Asia. He noted that the project involved complex logistics coordination, customs inspections, and on-site construction across multiple countries, making it far more challenging than typical export projects.

“Cross-continental delivery is not just about shipping equipment to a port. It’s a full-chain verification process involving supply chain integration, transportation coordination, and on-site execution,” Yogi emphasized. MGS’s ability to successfully carry out this project stemmed from its precise grasp of Asian manufacturing strengths and Central American market demands.

He further explained that the reason clients chose MGS is because of its ability to maintain consistently high standards from production in Asia to on-site execution in Central America. “For cross-continental projects, trust is the core, and execution capability is the ultimate guarantee of delivery.”

Demonstration Effect Sets In: Rising Demand for Shared Operating Rooms and Specialized Equipment

With Costa Rica’s first batch of integrated operating room equipment successfully installed, procurement demands have surged rapidly. Mike Kuo, Director of MGS Central America, revealed that local institutions have already signed letters of intent with MGS to expand cooperation, planning to increase procurement of operating room equipment within the next year.

Furthermore, because many private clinics lack their own surgical spaces, the business model of shared operating rooms and equipment leasing is gradually taking shape, providing new business scenarios. Meanwhile, specialties such as ENT and dentistry are also seeing increasing demands for equipment upgrades, including treatment chairs, endoscopy systems, and 8K ultra-high-definition surgical teaching imaging equipment.

Asian Devices Shift Focus from Price to System Integration and Clinical Practicality

“The competitiveness of Asian devices is no longer just about low prices,” Yogi noted. Modular architecture, system compatibility, and ease of maintenance have become critical factors in product selection and client decision-making. MGS pays particular attention to integration across different brands and on-site usability during product selection, and collaborates with clinical experts to verify product quality.

In the post-pandemic era, Central America’s healthcare systems are accelerating their equipment renewal processes. Industry estimates predict that in the next two years, over 50 procurement projects for integrated and specialized medical equipment will be launched, benefiting regional hospitals, clinics, and teaching medical institutions. Under budget constraints, Asian devices that balance functionality and long-term stability are becoming the preferred choice for more institutions.

“Asian manufacturers understand that clients are not just looking for price advantages—they need comprehensive solutions that are usable, durable, and come with long-term service guarantees,” Yogi pointed out. This product positioning and service model will be key for Asian devices to earn trust in the market.

From Single Device Exports to One-Stop Integrated Solutions: Asian MedTech is Reshaping Central America’s Medical Supply Chain

Asian medical devices are progressively redefining the supply chain landscape of Central America, shifting from single equipment exports to one-stop integrated system implementations. MGS stated that as project volumes continue to grow, the company is evaluating the establishment of regional maintenance centers, training bases, and logistics hubs in Central America to further strengthen after-sales service and local support capabilities.

Against the backdrop of global medical resource reallocation and continuous adjustments to cost structures, companies capable of integrating Asian manufacturing, global delivery, and localized services are becoming indispensable drivers of Central America’s healthcare upgrades.